high iv stocks meaning

Option Premium CallPut is. Put simply IVP tells you the percentage of.

An expensive stock compared to others especially others in the same sector.

:max_bytes(150000):strip_icc()/dotdash_INV_final-52-Week-Range_Feb_2021-02-40c49fe9287645d5a2b8b0308b77fa5f.jpg)

. Starting with a 100000 portfolio we will not allocate more than. Buy sell Stocks commission-free with Robinhood Financial. The scanner is useful if you plan on trading options using popular Theta Gang strategies such as The Wheel and the Cash-Secured Put or even Vertical.

SmartVestor Pros are legally bound to act in your interestno bozos no crooks. Implied volatility is a measurement of how much a security will move up or down in a specific time period. Implied Volatility Definition.

Traders with an investment mindset will. IV Rank is the at-the-money ATM average implied volatility. IV implied volatility of your options expiration cycle.

Implied Volatility refers to a one standard deviation move a stock may have within a year. Ad Learn why over 370K members have invested over 25 billion with Yieldstreet. Implied volatility is directly influenced by the supply and demand of the underlying options and by the markets expectation of the share prices direction.

Ad Do Your Investments Align with Your Goals. Ad There are Five Innovative Trends Changing the Way We Live and Work. Implied volatility shows the markets opinion of the stocks potential moves but it doesnt forecast direction.

Still let us begin with a basic definition of it. IV is useful because it offers traders a. If the implied volatility is high the market thinks the stock has.

Traders should compare high options volume to the stocks average daily volume for clues to its origin. Invest in the Growth Around You with iShares Megatrend ETFs. Ad Build Your Portfolio Your Way.

DTE days to expiration of your option contract. Choose Investments Using 0 Online Stock and ETF Trades. IV crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp decline following the occurrence of significant corporate events such as.

Analysts may recommend a high. In simple terms its an estimate of expected movement in a particular stock. An IV crush happens when the anticipated move on an underlying.

Find a Dedicated Financial Advisor Now. The goal here is to trade put options or credit spreads on High IV stocks based on the criteria outlined below. Choose Investments Using 0 Online Stock and ETF Trades.

A more stable stock will have a lower standard deviation. Implied Volatility is the expected volatility in a stock or security or asset. The Highest Implied Volatility Options page shows equity options that have the highest implied volatility.

A high-volatility stock has a higher deviation on average than other stocks. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. As expectations rise or.

If a stock is 100 with an IV of 50 we can expect to see the stock price move. IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. Generally a high-valuation stock has a comparatively high price-earnings ratio.

Ad Build Your Portfolio Your Way. Implied Volatility is no more a black box term for most of our options traders now. IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history.

In addition there are a number of strategies dealing with high-yield stocks including the Dogs of the Dow the Dow 5 and the Foolish Four. Ad Join 20M users on Robinhood today and get a free stock on us. Options serve as market based predictors.

Displays equities with elevated moderate and subdued implied volatility for the current trading day organized by IV percentile Rank. You may also choose to see the Lowest Implied Volatility Options by. Ad Americas millionaires didnt build wealth without an investing plan.

High IV Low IV. IV crush stands for implied volatility crush and goes along with a sudden drop in previously increased implied volatility. Definition and Examples of Implied Volatility.

The best way to find high IV stocks is through your broker account. With stock options this. Most brokers will have a scanner that can scan for high IV stocks.

For example the 1SD expected move of a 100 stock with an IV percentage of 20 is. Implied volatility IV is a metric used to forecast what the market thinks about the future price movements of an options underlying stock. If not you can use web based scanning.

Other fees may apply. Invest in asset classes traditionally dominated by hedge funds and the ultra-wealthy. This rank shows how low or high the current implied volatility is compared to where it has been at different times in the past.

As an example say you have six readings for. High IV Options Trading. Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move.

What you need to know about high-yield stocks.

What Is Volatility Definition Causes Significance In The Market

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

:max_bytes(150000):strip_icc()/dotdash_INV_final-Profiting-From-Position-Delta-Neutral-Trading_Feb_2021-01-08bb34eeb7d44e44b2105b421f1f73ba.jpg)

Profiting From Position Delta Neutral Trading

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03_3-64e23e71b7a54698a2f8ae064db57710.png)

10 Options Strategies Every Investor Should Know

What Is Vega N In Finance Overview How To Interpret Uses

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

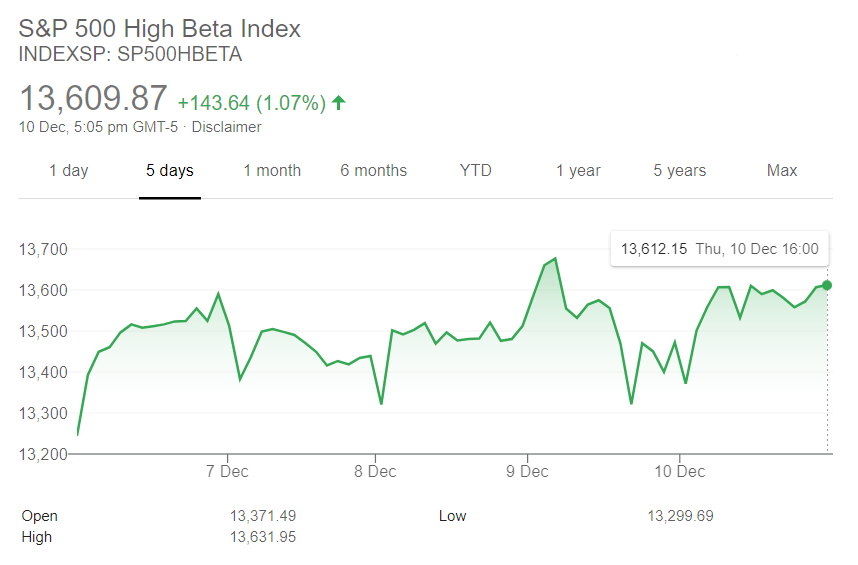

High Beta Index Overview How Beta Works Attractiveness

/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

Implied Volatility Explained The Ultimate Guide Youtube

Usdinr Is Correcting And Mostly In Minor Wave Iv Down 38 2 Retracement Is At 73 28 And The 20dma Is Rising And Sh Technical Analysis Analysis Business Data

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Extrinsic_Value_Curve_Apr_2020-01-010f32375f534dd78b2b8af044b8e65d.jpg)

/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)